The Most Functional Set of Tax Rules for Mobile Devices.

The most functional set of tax regulations for mobile devices prepared in cooperation with EY.

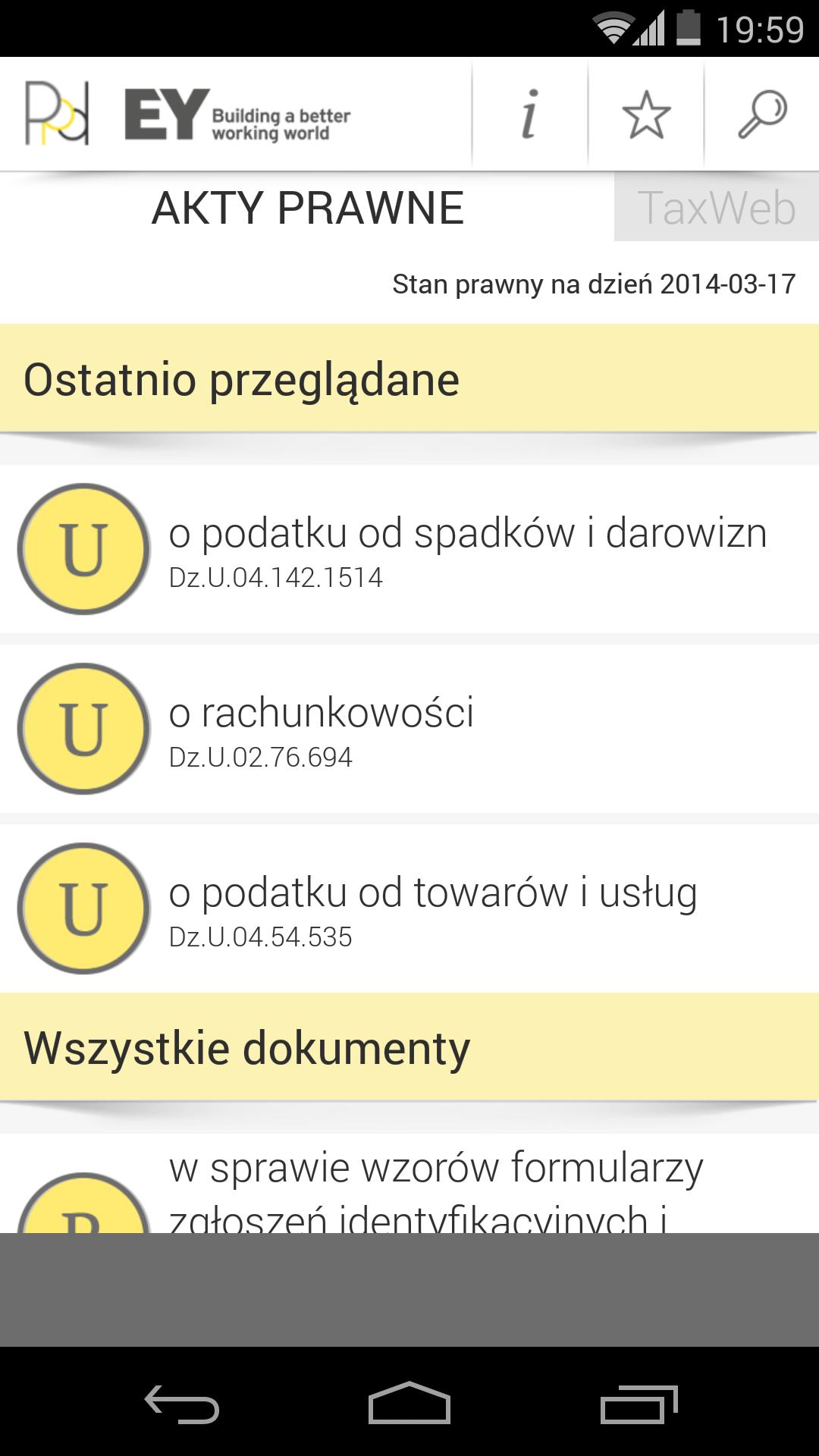

In the free version:

- access to a set of the most important tax laws;

- guarantee of updating the legal status at least once every 2 months;

- the ability to browse the rules in a convenient form;

- search engine that allows you to jump to the selected recipe or find the indicated phrase;

- adding your own notes to the text of the Act ...

- ... and the possibility of providing them with the content of the provision;

- comments with the designation when a given provision has been amended;

In the application you can buy the "Pro" version, which extends the basic functionalities by:

- quick updates of the legal status (usually no later than a few days after the entry into force of the amendment);

- a set of ordinances issued for laws from the basic version;

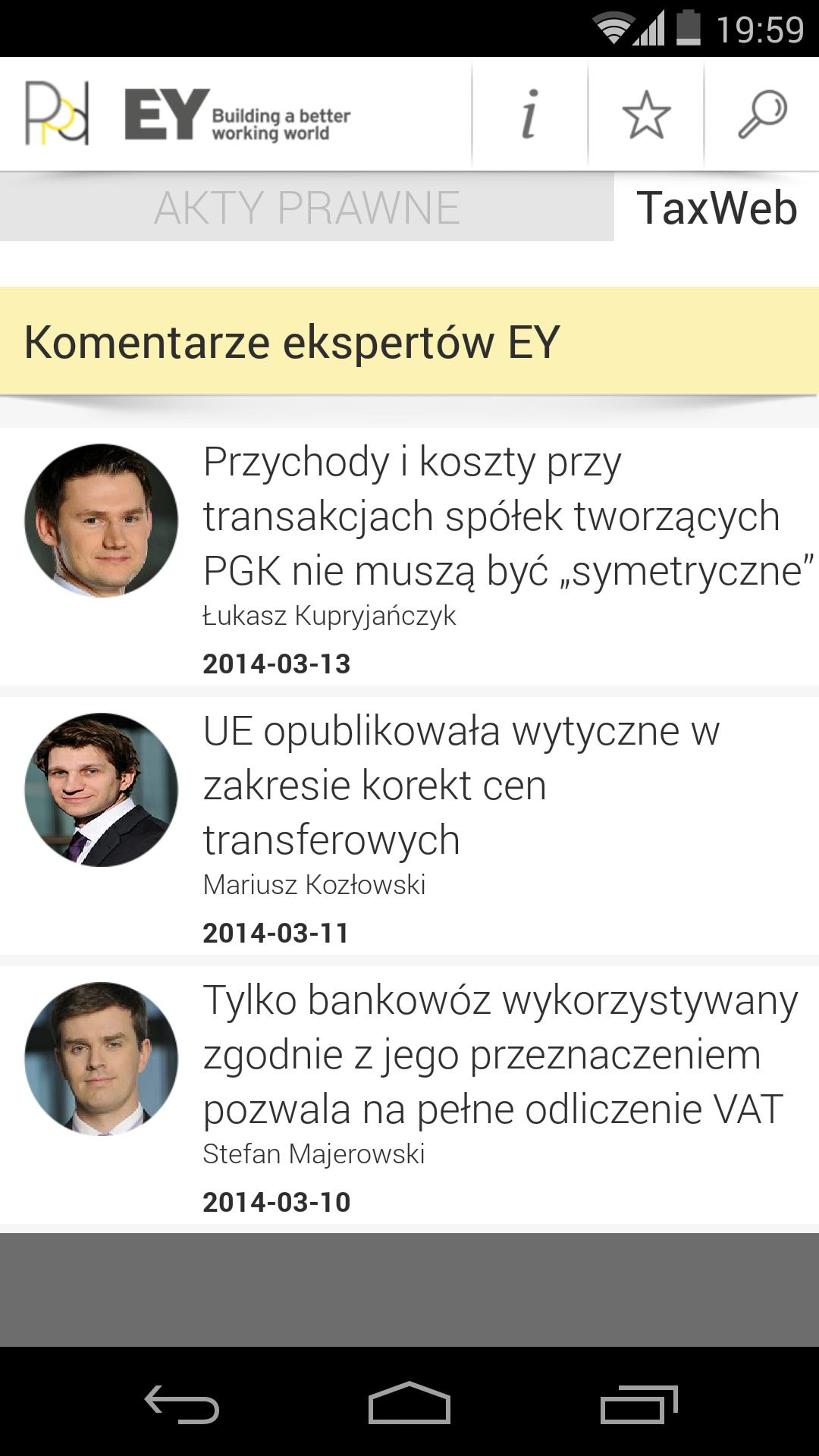

- blog with EY expert comments;

List of acts available in the application:

- Act of September 9, 2000 on tax on civil law transactions;

- Act of February 15, 1992 on corporate income tax;

- Act of August 29, 1997 - Tax Code;

- Act of September 29, 1994 on accounting;

- Act of October 13, 1995 on the principles of records and identification of taxpayers and payers;

- Act of November 20, 1998 on flat -rate income tax on certain revenues generated by natural persons;

- Act of March 11, 2004 on tax on goods and services;

- Act of July 28, 1983 on inheritance and donation tax;

- Act of July 26, 1991 on personal income tax;

- Act of December 6, 2008 on excise tax;

- Act of November 16, 2006 on stamp duty;

- Act of 12 January 1991 on local taxes and fees;

- Act of 24 August 2006 on tonnage tax;

- Act of July 5, 1996 on tax consultancy;

- Act of June 21, 1996 on tax offices and chambers;

- Act of September 28, 1991 on fiscal control;

- Act of 30 August 2002 - Law on proceedings before administrative courts.